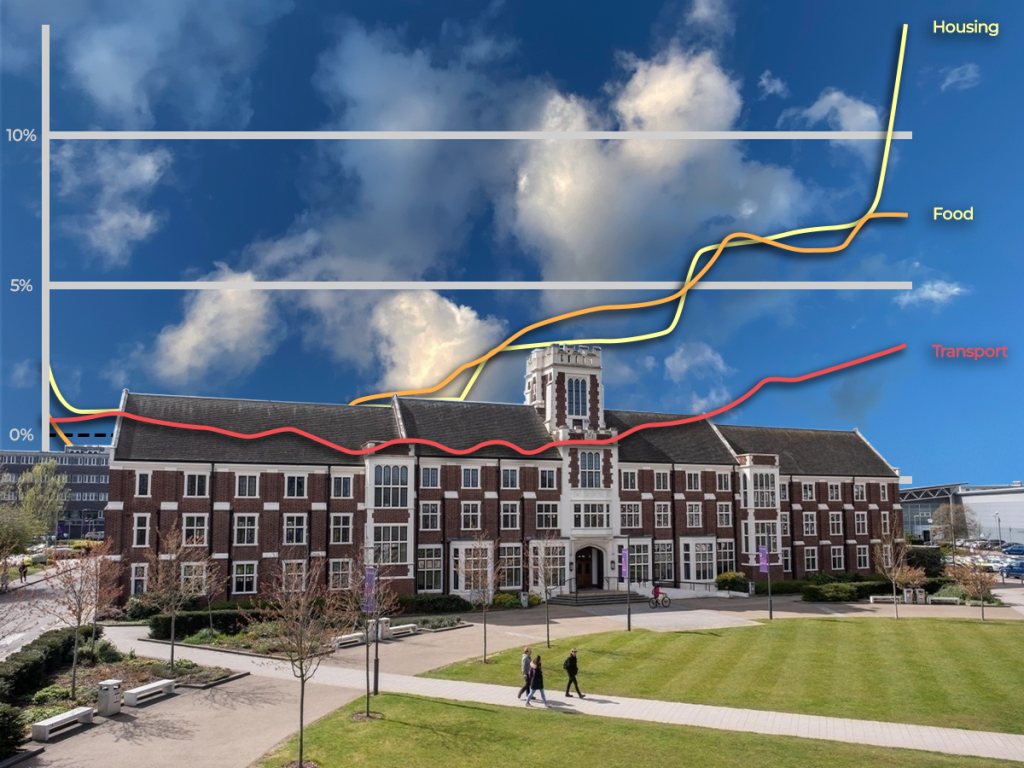

The Cost of Living crisis is affecting everyone in the UK; unfortunately, students are among those the most affected. Laura gives her money-saving strategies to help students out!

With the cost of living rising every week, what can students living off or on campus do to reduce their spending?

Living alone for the first time can be daunting when it comes to spending; it is unlikely that you can accurately calculate where your money goes and how much you are spending. It is vital to keep track of your expenses. This article will give tips on reducing your spending, especially when prices are rising.

To save money, budgeting is essential. Budgeting requires us to note where our expenses are going, think before spending, check our bank statements and plan what we need or want to spend our money on each month. Suppose we shop without thinking or on an empty stomach; we may buy things or food we don’t necessarily need. It is essential to separate wants and needs, prioritizing needs. With a budget, you may notice important aspects, for instance, that you may be spending a lot on a gym membership. In this case, you may want to find a substitute to stay fit or change to another gym. However, you mustn’t cut off your wants completely! Instead, prioritize and find substitutes.

This also applies to products and shopping. Keep an eye on cheaper substitutes, ensuring you investigate all the shop options you have in town. Some shops you have never considered may have what you need but at a lower price! For instance, I find Aldi sells supermarket supplies very cheaply. I always shopped in other, more expensive stores because they were closer to me. You may also find it better to make a big batch of food that lasts many days rather than buying many small things. Buying ingredients is expensive initially, but it can save you money in the long run. In addition, there is also a membership called TOTEM for groceries, which costs £14 for one year, £25 for two or £35 for three years. Savings include 10% off at the Co-op and 15% off at ASOS and National Express. For books and other bits and bobs, you may also want to consider visiting charity shops and secondhand stores, as you can buy things from one to five pounds which is a huge money saver!

As an international student from Spain, I also want to mention that Spain’s products have more additives and last longer than food in the UK. This caused me to do massive shops and resulted in me having to throw out half of the food I bought a week later. If you come from another country like mine in this aspect, keep an eye on the expiration dates!

Transport also takes a part of our expenses. Getting a railcard may prove helpful as it saves around two hundred pounds a year on average. Moreover, National Express also offers a Young Persons Coachcard for fifteen pounds that grants a third off of journeys, which is worth looking into. There is also a loophole on Trainline wherein you may find dividing your trip and buying more than one ticket from station to station for a long trip is cheaper than buying only one from your location to your destination.

Other general tips may be to save a small portion of the money you receive, whether from your parents or your part-time job, and try not to spend it. This way, in some months, you may have a lot of cash to spend on wants or a special outing. A part-time job is also an excellent way to balance student life and earn income. It is also essential to milk as many discounts and deals (such as meal deals) as you can. Many shops offer student discounts but do not mention them first, so it doesn’t hurt to ask in shops! Many university events and shops may also even give out free products. For instance, I got a free ketchup bottle that I used almost daily at the Societies fair!

Lastly, it is recommended that you “carpool” as much as possible! In other words, buy joint groceries and goodies with your flatmates, as sharing expenses, experiences and products are much cheaper.

In conclusion, as a student, you should keep an eye out for discounts and possible saving opportunities more than when you did not live independently. There are cards, discounts and tricks to prevent your money from being spent too often! Do not be afraid to ask for financial help from your family, as unplanned expenditures can happen while experimenting with life on your own.